Welcome Back to this budget series. If you haven’t done step I or step II you can click on the links and check em out. (The hyperlinks are in the highlighted words above.) We are going to take steps I and II and apply them in step III and in step IV I’m going to show you how being disciplined will give you 3-4 extra pay checks a year without working more than you are now.

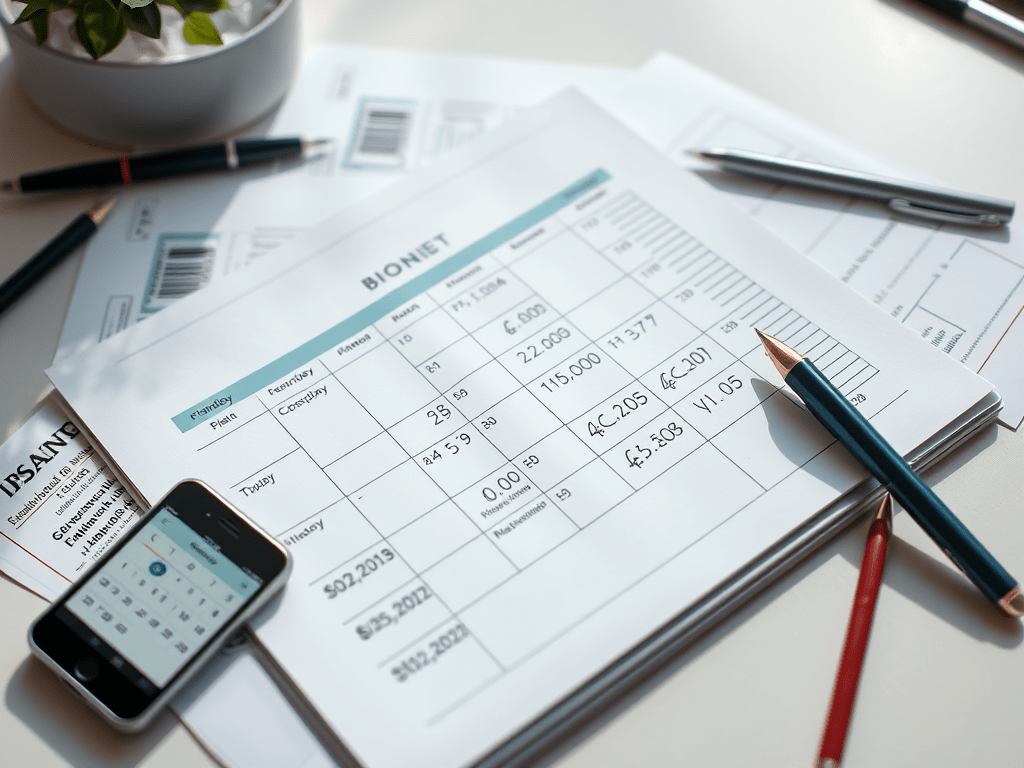

Take the information about your bills. Include details like their name, minimum payment, or average payment. Remember that things like utilities will fluctuate. Add their due date and apply them to a month. You can do this on a digital calendar like your phone or Google Calendar. You can also print one out or apply it to a planner.

Go down through your list.

On each due date, write the name of the bill. Include the minimum payment or the average payment.

Do this for every bill you pay every month.

Then stop. You’ve completed steps I, II,III! Way to go!

Stay tuned. In step IV, I’m going to show you how to give yourself an extra 3-4 paydays a year. You won’t need to work any extra.

Look forward to seeing y’all next time.

One thought on “Achieve Financial Discipline: Your Step-by-Step Guide”