Over a year ago I used to be very into seasonal décor, specifically with an attachment to Fall and Halloween décor. I used to be the place where we all gathered at every holiday and family event.

We now do it but with less members and that’s ok.

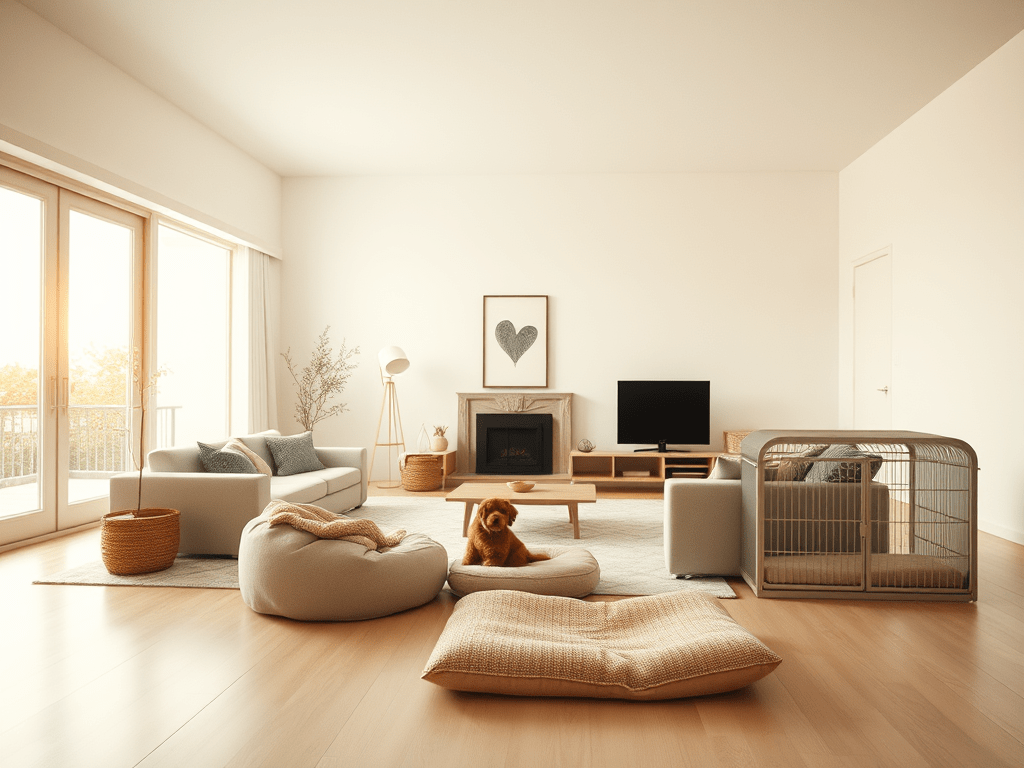

I no longer decorate seasonally except for plants and a Christmas tree. So, I sold or donated most of my seasonal décor with the exceptions of some wreaths. And that’s ok

The value and time that minimizing these events and accoutrements made way for less mental, physical and emotional clutter.

While I still enjoy the décor I do it from online or in a store. If a spooky loving baddie posts their décor, I don’t judge them or even envy them. I can start up if I want to. I talk about how awesome the set-up is. Sometimes when I’m out I’ll sent photos of where they can get unique stuff and let them know.

I live my days being creative in other ways while also having a sense of peace with the amount of energy and time I’ve save by not taking down and putting back up seasonal displays.

I also have my attention more in the present which is why I was able to appreciate this spider web. I guess I am still decorating seasonally I just lean more to the organic.

What say you are you a seasonal decorator or a minimal decorator?